Business task

This analysis explores the relationship between Costa Rica’s exchange rate, interest rate differentials, and tourism arrivals to determine the optimal timing for purchasing CRC. Using correlation analysis and Granger Causality Tests on data from BCCR, ICT, and FRED, the goal is to help investors and bankers better understand how key economic variables influence exchange rate behavior and enhance their decision-making strategies.

Data sources used

The analysis uses publicly available, credible data from official sources:

- BCCR exchange rate and interest rate datasets

- ICT tourism arrivals dataset

- FRED Federal Funds Effective Rate dataset

The data covers the period from January 1, 2009 to December 31, 2024, organized daily or monthly depending on the source. To ensure consistency, monthly averages were calculated where necessary. All datasets were reviewed and show no missing values. There are no concerns regarding bias, licensing, privacy, or security. These datasets support robust correlation and causality analyses to evaluate the drivers of Costa Rica’s exchange rate.

Tools used

For this project, I used Google Sheets and R (ggplot2 and lmtest packages).

Manipulation of data

Monthly averages were calculated from BCCR datasets using the formula:

=AVERAGEIFS(B6:B371, A6:A371, “*Ene*”, B6:B371, “>0”)

This method excludes zero values typically recorded on weekends or holidays, ensuring that averages reflect active market data only.

Analysis

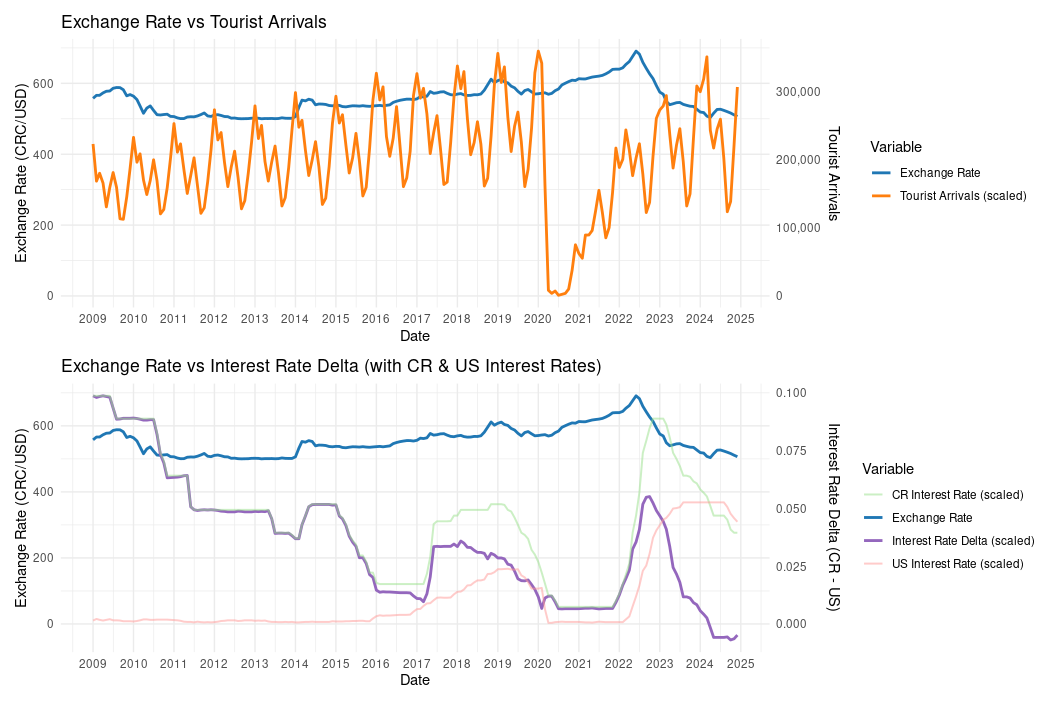

Tourist arrivals peak in January and drop in September. Major economic events—such as the 2008 U.S. financial crisis, 2014 BCCR policy shifts, 2018 fiscal crisis, and 2020 COVID-19 pandemic—corresponded with sharp exchange rate increases, followed by gradual normalization.

Despite a steady rise in tourism revenue, it has not significantly suppressed the exchange rate, with recent data showing increased tourism alongside a declining exchange rate. Interest rate differentials (CR – US) often rise after exchange rate shocks, suggesting a monetary policy response to attract capital inflows. However, the current historically low differential, paired with a continued decline in the exchange rate, casts doubt on the short-term predictive power of this metric.

These patterns indicate that neither tourism nor interest rate differentials alone can reliably forecast exchange rate trends, highlighting the need for a more integrated modeling approach when advising on CRC purchasing decisions.

Granger Causality Test Results:

- Tourist Arrivals → Exchange Rate: No significant causality (p = 0.1457 at 1 lag).

- Exchange Rate → Tourist Arrivals: Some reverse causality (p = 0.0839 at 4 lags), suggesting the exchange rate may influence tourism demand.

- Interest Rate Delta (CR – US) → Exchange Rate: Statistically significant (p = 0.0046), indicating the differential impacts the exchange rate.

- Exchange Rate → Interest Rate Delta: Strong reverse causality (p = 7.1e-06), suggesting exchange rate changes trigger monetary policy responses.

- Costa Rica’s Interest Rate → Exchange Rate: Very strong causality (p = 3.4e-08), showing a direct effect of domestic monetary policy on the exchange rate.

Visualizations

Further exploration

- Areas for deeper analysis include:

- Capital inflows from international loans

- Unrecorded currency inflows (e.g., narco dollars)

- Scenario analysis tools to simulate interest rate shocks and their effects on exchange rate dynamics.

Insights

- Domestic interest rates are the primary driver of Costa Rica’s exchange rate. Granger tests show strong causality and feedback effects, indicating that monetary policy both influences and responds to exchange rate changes.

- Tourism has limited influence on exchange rate movements. While some weak reverse causality exists, tourism is not a major determinant of currency fluctuations.

- Interest rate differentials with the US remain relevant, highlighting the importance of tracking external financial conditions in parallel with domestic policy.